Business Rule Number One: Never Run Out of Cash!

I mentioned in a recent video (“Why Do CEOs Fail”) that I had worked with several first time CEOs in the last year. Most of them had come through the ranks and learned the critical elements of business (or at least some of them!) and were looking for refinement. A few, however, had very little business experience or else had deep knowledge but in only one segment of business.

Leaders are swamped with messages about culture, purpose, values (all important!) and most recently their societal obligations. But there is a “technical” aspect to their business that they cannot ignore, financial acumen.

If you are going to run a business, you must understand your finances or you are at extreme risk! I have seen profitable businesses get into life and death situations because of a lack of financial acumen. An addressable market, a viable product and happy customers are not good enough! And having a good accountant or a CFO is great but not sufficient!

If you are running a company and don’t understand the following, please get some help before it’s too late!

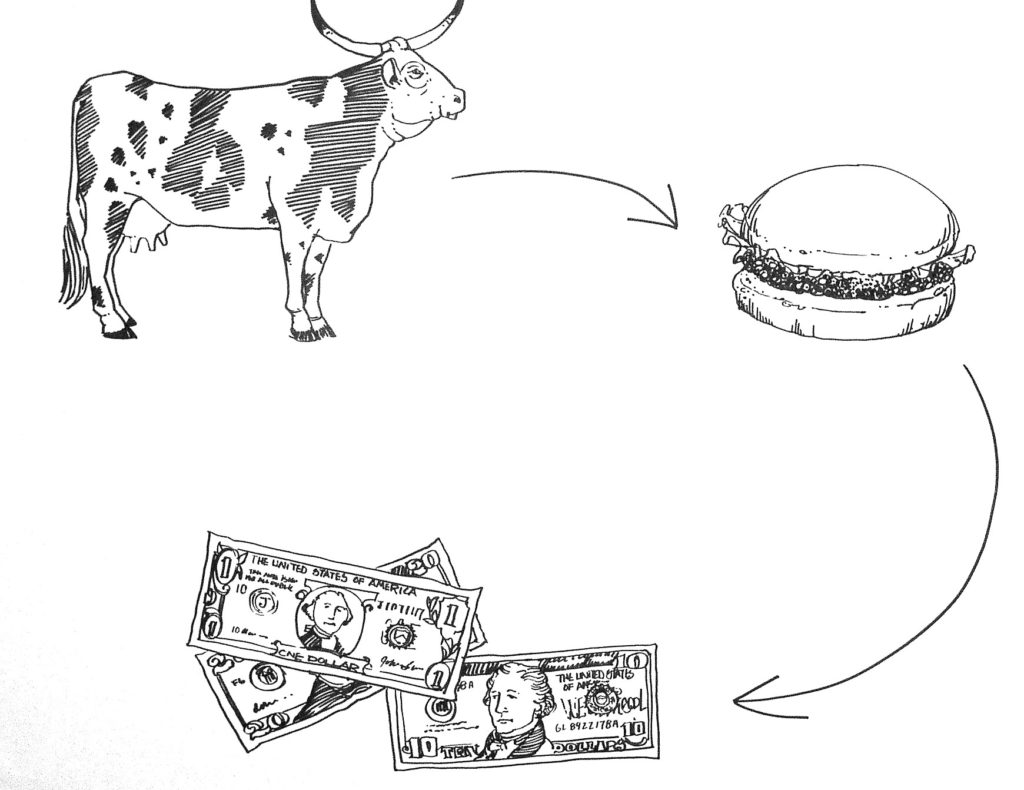

1. Your cash conversion cycle. (I.e., How fast you turn expenses like inventory or labor into cash from sales.) If you run a hamburger joint, it looks something like the picture above. When do you pay for the cow? When do you pay your staff? Do you sell on credit? How fast can you turn the cow into a cash cow? Some businesses have a negative cash conversion cycle. They are compensated by their customers before they must pay their bills (a wonderful thing!). Some, on the other hand, have lots of inventory, work in progress and then sell on credit. They may be extremely profitable, but when they grow, they decrease cash significantly so must either put in lots of equity or borrow lots of money.

2. Cash flow statements. Cash flow is not the same a profit. As noted above, you can be very profitable and pay lots of taxes and go broke. (You can also show no profit and still generate lots of cash—at least for a while—but that’s another story!) You need to have a profit and loss statement, but without a cash flow statement you’re driving with one eye closed.

3. A cash flow forecast. You need to look forward to make sure that you are not going to run out of cash and rule number one in business is don’t run out of cash! You need a simple tool, with some margin of error built in, to be able to forecast your cash needs.

4. Your banking relationship, specifically your loan covenants. If you must borrow money to run your business (see #1), and your bank wakes up one day and wants their money back, you’re in deep doodoo. Do you completely understand the covenants that you agreed to when you signed the loan documents? If you have a hiccup and break a covenant or two, you’ll need a plan! I’ve seen this happen many times!

5. Your greatest risks (e.g., customer concentration). If you sell on credit, do you know the financial situation of your largest customers? If one of them decides to slow pay you (or not pay you!) can you survive? If a key component of your product shows up a month or two late, can you survive? Do you have other sources?

6. Net profit by customer and by product. You may have a customer that looks very profitable. You sell him $1mm in product per year and your inventory and labor costs are only $800k. However, he pays his bills 90 days after he receives his product. He returns product that doesn’t sell or is damaged (by his judgement alone). He requires lots of hand holding by your sales department, your service department, and your accounting department. He may be profitable on a gross profit basis, but on a net basis, you’re losing your shirt! If you have a few of these, you’re in trouble!

If you have climbed the ladder to the CEO’s office or perhaps inherited a business, congratulations! You have the chance to do good work, create meaningful employment and provide for your family. Don’t screw it up because you didn’t take the time to deeply understand the financial aspects!

coaches CEOs to higher levels of success. He is a former CEO and has led teams as large as 7,000 people. Todd is the author of, Never Kick a Cow Chip On A Hot Day: Real Lessons for Real CEOs and Those Who Want To Be (Morgan James Publishing).

Connect with Todd on LinkedIn, Twitter, call 303-527-0417 or email [email protected].